-Darren Leavitt, CFA

Financial Markets ended the month of May with mixed results. A prominent rotational trade was again present throughout the month. Inflation was top of mind and debated by investors as some economic data fueled concerns of a systemic increase in goods and services prices. In Washington, politicians continued to discuss the inputs and size of an infrastructure spending plan while the Federal Reserve maintained its current monetary policy stance. First-quarter earnings season finished with stellar results but mixed price action. Cryptocurrencies were extremely volatile and settled at levels well below their most recent highs by month-end.

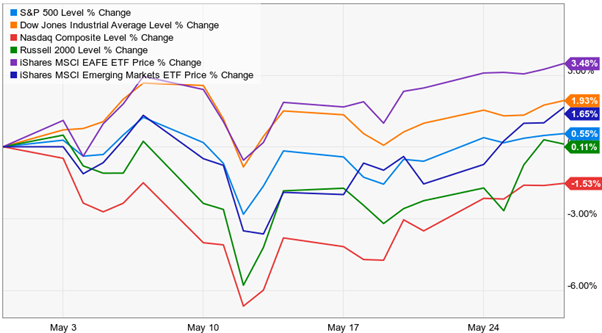

The S&P 500 gained 0.55% for the month, the Dow was higher by 1.93%, the NASDAQ fell 1.53%, and the Russell 2000 inched out a 0.11% increase. Developed international markets increased by 3.48%, while emerging markets gained 1.65%. Despite all the worries about inflation, the US Treasury yield curve flattened. The 2-year note yield fell two basis points to 0.14%, and the 10-year bond yield dropped five basis points to 1.58%. Interestingly, gold often thought of as a hedge against inflation, increased 7.5% or $134.30 to close at $1902.20 an Oz. Oil prices continued to rise, gaining 4.5% or $2.81 to close at $66.32 a barrel.

The global vaccination efforts continued in May, and we continued to see significant shots being put into the arms of Americans and Europeans. India continued to struggle with its efforts and saw infection rates and deaths soar but did see substantial progress towards the end of the month.

The closure of the global economy has disrupted some supply chains, and we are starting to see the ramifications of these disruptions. Inflation measures such as the CPI, the PCE Price Index, and inflation expectations in sentiment indicators all ticked higher in May. Used Cars, Rental Cars, Airfares, and Hotel room prices led these price data sets higher. The debate on whether these price increases are systemic or transitory was a considerable influence on the markets in May. If you believe what the Federal Reserve told us at their May meeting and the action seen in US Treasury bonds, it currently appears transitory. If you look at prices in the commodity complex such as Gold, Oil, and industrial metals, perhaps it seems a little stickier. Wages are a significant variable in the inflation equation, but the labor data in May was blurry. For instance, the April Employment Situation report showed just 266k non-farm payrolls created; expectations were for 1 million jobs to be made. We also saw the Unemployment rate tick higher to 6.2%. On the other hand, we saw Initial Claims and Continuing Claims trend lower. The tepid increase in jobs has some calling for the end of the enhanced unemployment benefits, which some argue keep perfectly able workers from going back to the workforce. Wall Street will continue to ascertain inflation, and it will certainly significantly influence the markets in the coming months.

The information in this Market Commentary is for general informational and educational purposes only. Unless otherwise stated, all information and opinion contained in these materials were produced by Foundations Investment Advisers, LLC (“FIA”) and other publicly available sources believed to be accurate and reliable. No representations are made by FIA or its affiliates as to the informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. No party, including but not limited to, FIA and its affiliates, assumes liability for any loss or damage resulting from errors or omissions or reliance on or use of this material.

The views and opinions expressed are those of the authors do not necessarily reflect the official policy or position of FIA or its affiliates. Information presented is believed to be current, but may change at any time and without notice. It should not be viewed as personalized investment advice. All expressions of opinion reflect the judgment of the authors on the date of publication and may change in response to market conditions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. You should consult with a professional advisor before implementing any strategies discussed. Content should not be viewed as an offer to buy or sell any of the securities mentioned or as legal or tax advice. You should always consult an attorney or tax professional regarding your specific legal or tax situation. Investment advisory services are offered through Foundations Investment Advisors, LLC, an SEC registered investment adviser.

Jim E. Sloan is the founder of Jim Sloan & Associates, LLC, a comprehensive wealth management firm located in The Woodlands, Texas. Jim is an Investment Adviser Representative providing investment advisory services through AE Wealth Management, LLC, an *SEC Registered Investment advisor. This relationship allows Jim Sloan & Associates, LLC to bring institutional-level experience, practices, and pricing to individual families. Jim is also a licensed insurance agent in Colorado and Texas. This is Jim’s sixth financial book and is aimed at helping investors become financially informed. Jim is a U.S. Army veteran, native Houstonian, and lives in the Woodlands, volunteers with several local charities, believes in the name of Jesus, loves to travel, and enjoys most things outdoors.

Jim E. Sloan is the founder of Jim Sloan & Associates, LLC, a comprehensive wealth management firm located in The Woodlands, Texas. Jim is an Investment Adviser Representative providing investment advisory services through AE Wealth Management, LLC, an *SEC Registered Investment advisor. This relationship allows Jim Sloan & Associates, LLC to bring institutional-level experience, practices, and pricing to individual families. Jim is also a licensed insurance agent in Colorado and Texas. This is Jim’s sixth financial book and is aimed at helping investors become financially informed. Jim is a U.S. Army veteran, native Houstonian, and lives in the Woodlands, volunteers with several local charities, believes in the name of Jesus, loves to travel, and enjoys most things outdoors.