Weekly Market Commentary – 5/21/2021

-Darren Leavitt, CFA

The financial markets were in consolidation mode as a volatile risk-off trade in cryptocurrencies exacerbated concerns about inflation and valuations. A sell-off in commodities curbed investors’ appetite for cyclicals while growth sectors found some reprieve. First-quarter earnings announcements continued to surprise, but price action was mixed. The Federal Open Market Committee minutes were released but were a non-event. The minutes did suggest that some members were open to tapering the current asset purchase program later in the year. Economic data was mixed for the week.

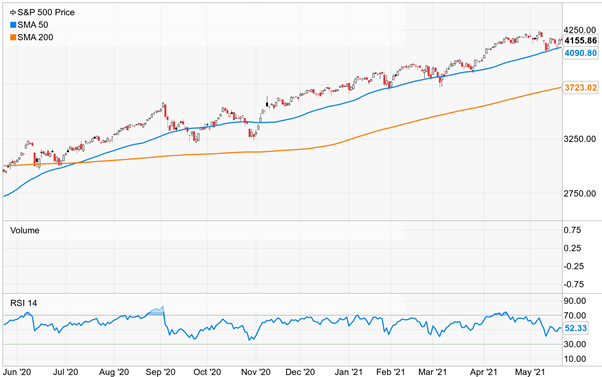

The S&P 500 lost 0.43%, the Dow gave up 0.51%, the NASDAQ gained 0.31%, and the Russell 2000 fell 0.42%. The US Treasury curve ended up pretty much where it started the week. The 2-year note yield was unchanged at 0.15%, and the 10-year yield fell one basis point to 1.63%. Gold prices rose 2% or $38.90 to close at $1876.80 an Oz. WTI fell with the broader commodity complex losing 2.5% or $1.69 to close at $63.64 a barrel.

At first glance, it appears that the market action was somewhat muted last week. However, the activity underlying the major indices saw selling in the most recently favored cyclicals. Financials, Energy, Industrials, and Materials sold off while Real Estate, Utilities, and Consumer Staples outperformed. Lowes, Home Depot, and Macy’s all had solid Q1 earnings reports but sold off after their announcements. Walmart, Target, and Palo Alto Networks also announced solid results but were awarded higher prices. Cybersecurity issues were well bid on the week after the administration announced new initiatives to address ransomware attacks.

Bitcoin and other cryptocurrencies sold off hard over the week in very volatile trade. The Chinese government announced that they would increase regulations on crypto and curb crypto mining initiatives. Bitcoin fell as low as 30k before a rebound to 38k on Friday. Some pundits fear the move portends further risk-off action in the broader market.

Economic data was mixed. Housing Starts decelerated in April, falling 9.5% on a month over month basis or an annualized rate of 1.569 million. Building permits rose 0.3% to total permits of 1.76 million. The slight increase may be due to the higher costs facing builders, namely, land, materials, and labor. Initial Jobless Claims fell 34k to 444k, another low post-pandemic. Continuing claims regressed about coming in up 111k to 3.751 million. The Conference Board’s Economic Index came in better than expected and showed solid results in the leading indicators. IHS Markit Manufacturing and Services were both better than expected at 61.5 and 70.1, respectively.

The information in this Market Commentary is for general informational and educational purposes only. Unless otherwise stated, all information and opinion contained in these materials were produced by Foundations Investment Advisers, LLC (“FIA”) and other publicly available sources believed to be accurate and reliable. No representations are made by FIA or its affiliates as to the informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. No party, including but not limited to, FIA and its affiliates, assumes liability for any loss or damage resulting from errors or omissions or reliance on or use of this material.

The views and opinions expressed are those of the authors do not necessarily reflect the official policy or position of FIA or its affiliates. Information presented is believed to be current, but may change at any time and without notice. It should not be viewed as personalized investment advice. All expressions of opinion reflect the judgment of the authors on the date of publication and may change in response to market conditions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. You should consult with a professional advisor before implementing any strategies discussed. Content should not be viewed as an offer to buy or sell any of the securities mentioned or as legal or tax advice. You should always consult an attorney or tax professional regarding your specific legal or tax situation. Investment advisory services are offered through Foundations Investment Advisors, LLC, an SEC registered investment adviser.

Jim E. Sloan is the founder of Jim Sloan & Associates, LLC, a comprehensive wealth management firm located in The Woodlands, Texas. Jim is an Investment Adviser Representative providing investment advisory services through AE Wealth Management, LLC, an *SEC Registered Investment advisor. This relationship allows Jim Sloan & Associates, LLC to bring institutional-level experience, practices, and pricing to individual families. Jim is also a licensed insurance agent in Colorado and Texas. This is Jim’s sixth financial book and is aimed at helping investors become financially informed. Jim is a U.S. Army veteran, native Houstonian, and lives in the Woodlands, volunteers with several local charities, believes in the name of Jesus, loves to travel, and enjoys most things outdoors.

Jim E. Sloan is the founder of Jim Sloan & Associates, LLC, a comprehensive wealth management firm located in The Woodlands, Texas. Jim is an Investment Adviser Representative providing investment advisory services through AE Wealth Management, LLC, an *SEC Registered Investment advisor. This relationship allows Jim Sloan & Associates, LLC to bring institutional-level experience, practices, and pricing to individual families. Jim is also a licensed insurance agent in Colorado and Texas. This is Jim’s sixth financial book and is aimed at helping investors become financially informed. Jim is a U.S. Army veteran, native Houstonian, and lives in the Woodlands, volunteers with several local charities, believes in the name of Jesus, loves to travel, and enjoys most things outdoors.